5 Best Crypto Staking Wallets

Crypto staking has gained massive popularity since the advent of decentralized finance (DeFi) in 2020. Cryptocurrency natives looking for stable returns outside of the usual volatile returns from trading crypto assets have flocked to staking wallets and services to diversify their portfolios. Many popular crypto exchanges like Binance and Kraken have started offering staking products in certain countries so even those newer to the space can start earning yield on their assets. Staking of stablecoins in high-inflation countries like Sri Lanka, Turkey and South Africa has also provided an easy way for many to protect themselves against inflation while earning a stable return on USD-denominated assets.

In this article we’ll cover the best crypto staking wallets, but to start we’ll shortly cover how staking works and some considerations you should make.

How Crypto Staking Works?

Crypto staking has become a pervasive term for the many ways to earn a return for holding crypto assets over the last few years. However the correct definition of staking is when your assets are put to work to secure the blockchain on proof-of-stake chains like Polygon, Tezos, and soon Ethereum. Your assets are used to validate transactions and therefore earn a reward back. However staking has now become a popularized term for holding assets within a wallet or exchange and receiving a reward. Usually this reward is generated by lending out your assets and earning interest – but it can also be earned by providing liquidity to exchanges. If you’re using a centralized exchange for staking, you won’t have any visibility on how your returns are generated, but if you choose to use a non-custodial wallet you have direct access to the staking protocols and will be able to understand how your returns are generated.

Other Considerations

Is Crypto Staking Worth it?

Whether crypto staking is worth it is a decision you’ll need to make yourself based on your investment or saving goals. When staking stablecoins which are pegged to the US dollar, you typically earn a return between 2-5%. This is orders of magnitude higher than a savings account with a traditional bank, but you need to decide if this is worth the risk as crypto staked is not government insured or guaranteed like a bank account.

Other crypto assets like Ethereum and Polygon can earn much higher returns, sometimes over 10% – but by holding and staking those assets you are also exposed to the price volatility of that asset itself.

Is Crypto Staking Safe?

Crypto staking comes with an element of risk. If you stake with a centralized exchange you don’t know how the returns are being generated and whether or not the exchange is taking undue risk with your assets. Staking with a non-custodial wallet is more transparent as you have direct access to the pools where your assets are staked – however there is an element of smart contract risk. You should always research the staking applications, review if audits have been done by reputable firms, and consider how much the protocol has been used already by others. At the time of writing, popular borrowing and lending protocol Aave has $16B staked in the protocol and is largely seen as the safest way to stake crypto assets.

The Best Staking Wallets

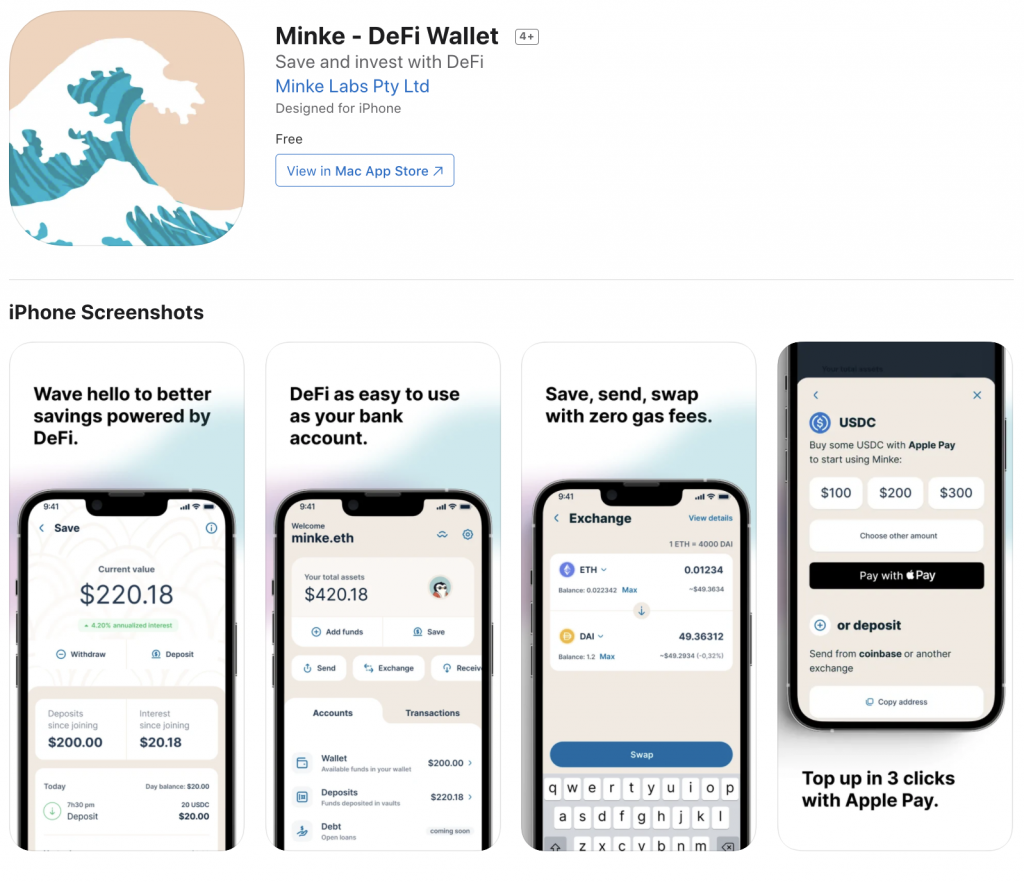

Minke

We may be biased, but we’re confident that our app Minke is the best crypto staking wallet. Minke is a self-hosted and gasless staking wallet built on the Polygon network. As a self-hosted wallet Minke gives you full ownership and sole access to your assets, meaning there isn’t an authority that can access or block you from your funds. Minke is also available globally and you can buy crypto in only 3 clicks with Apple Pay. Bank transfers are also available in many countries including Brazil, Turkey and Australia.

In Minke you can buy USDC which can be used for staking and this can be done in only a few clicks after adding funds to your account. Minke allows you to stake USDC and other stablecoins in popular protocols like Aave and mStable. The rates are variable but at the time of writing mStable’s save pool generated 9.44% APY as an average over the past year. Minke gives your direct access to the staking pools and doesn’t take any fees or margins therefore you are getting the full amount your money earns. If you’re new to crypto, the interface feels intuitive and familiar to your bank account with a separate account for savings. At this time only stablecoins are available for staking but other coins like Polygon (MATIC) will soon be made available.

Non-Custodial: Yes

US Availability: Yes

Global Availability: Yes

Available Assets: Stablecoins

Devices: Mobile (iOS)

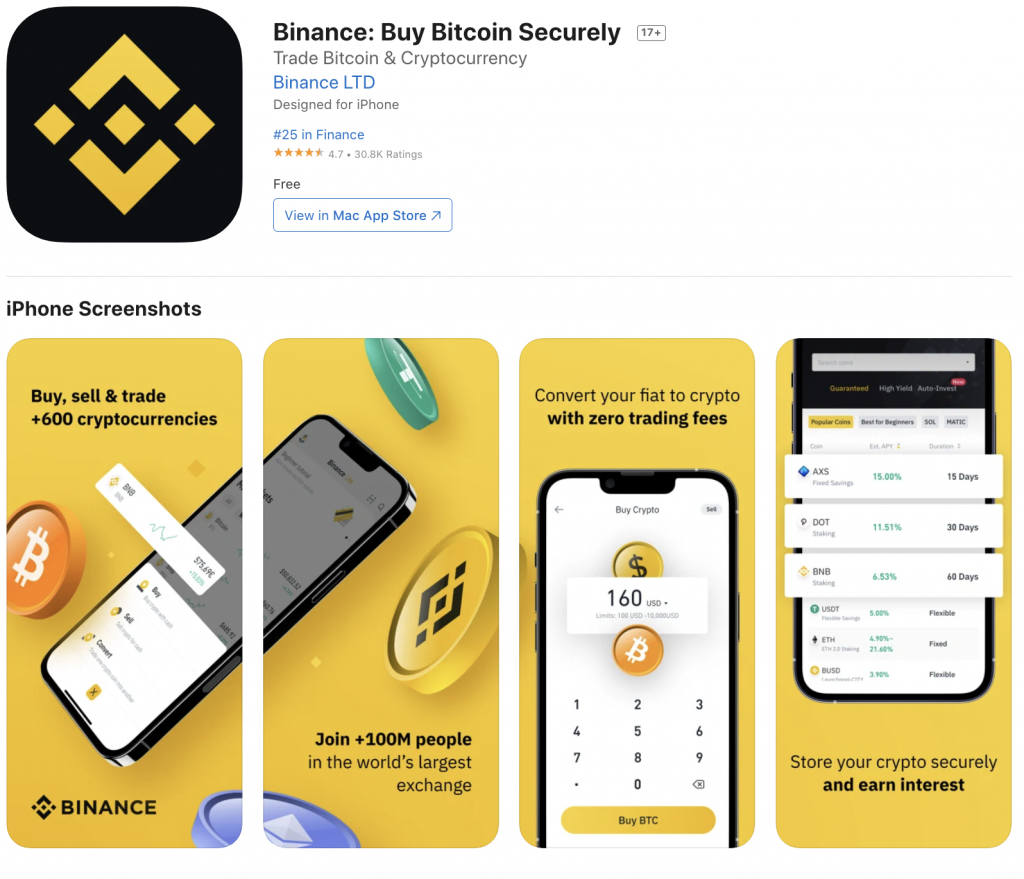

Binance

Binance is one of the most popular crypto exchanges globally and therefore a natural leader when it comes to wallets to stake your crypto. Binance Earn has two products – Locked Staking and DeFi staking. Binance easily offers the most assets available for staking on chains like Avalanche, Harmony and Algorand. Most coins on the Locked Staking product require a 30 day minimum lock up period in order to earn staking rewards. However the DeFi Staking product has the option of flexible lockups meaning no lock period is necessary, and it’s available on all stablecoins.

Though Binance is a centralized exchange, they do give some visibility on where the returns are generated from on their DeFi staking product as most of the time your assets are lent out through Venus – a lending and borrowing protocol on Binance Smart Chain (BSC). There is no visibility on returns on the Locked Staking product.

Because Binance Earn is a centralized product it is bound to geographic restrictions, therefore it’s not fully available on Binance.US other than for limited assets like BNB, SOL and AVAX. Binance does not publish a list of countries it is available in however some users have reported not being able to access the service in countries like Malaysia, Thailand and the UK.

Self-Custody: No

US Availability: Limited

Global Availability: Mostly

Available Assets: Stablecoins and many others

Devices: Desktop & Mobile

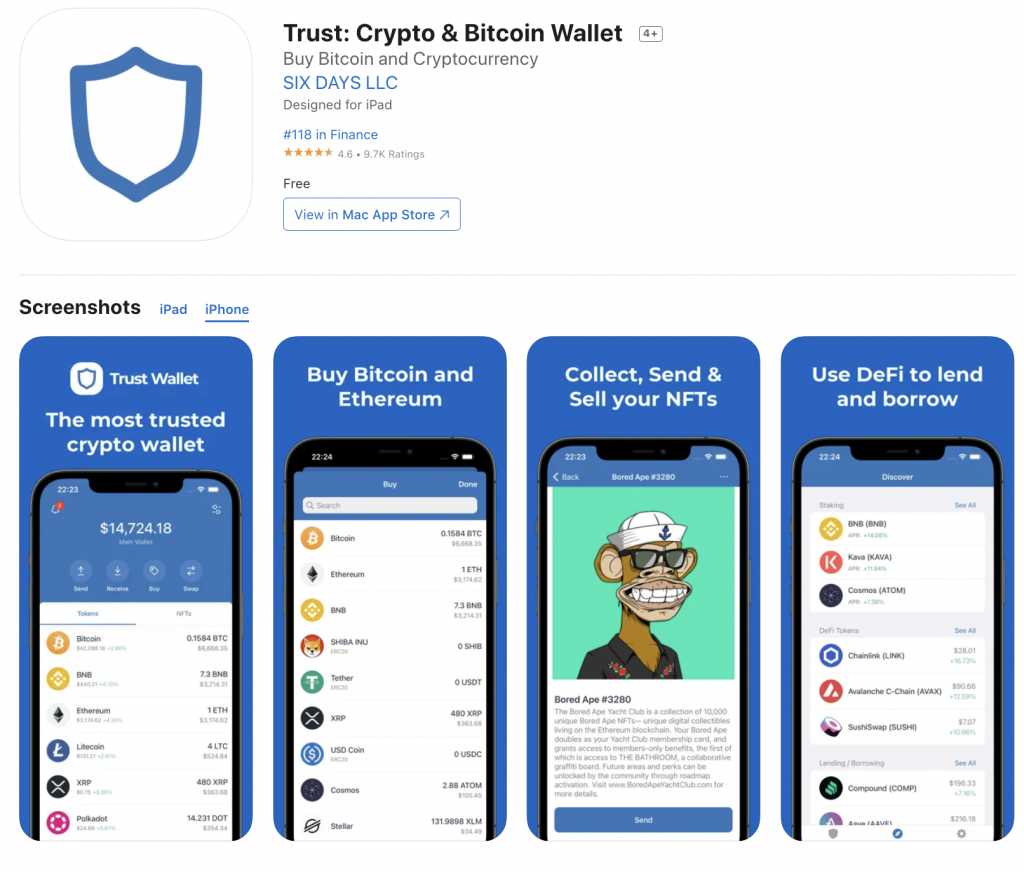

Trust Wallet

Trust Wallet as in its name is one of the most trust wallets in the crypto industry having launched in 2017 as one of the first open-source Ethereum wallets. In 2018 they were acquired by Binance and have since come to support multiple chains including Bitcoin and Binance Smart Chain (BSC). Trust Wallet is known for its security and for never requesting private information or data.

Trust Wallet has limited assets available for staking but it does offer staking for popular coins including SOL, ATOM and XTZ.

Self-Custody: Yes

US Availability: Yes

Global Availability: Yes

Available Assets: SOL, OSMO, KAVA, ATOM, BNB, XTZ, TRX

Devices: Mobile (iOS & Android)

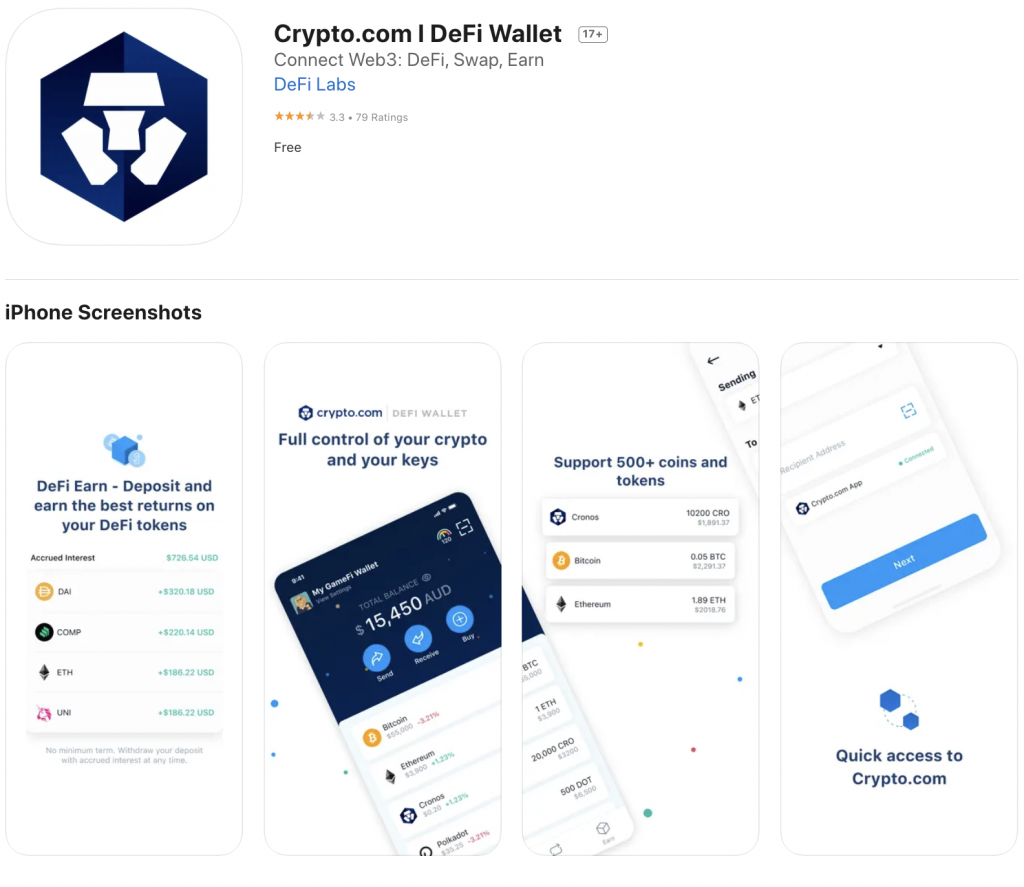

Crypto.com DeFi Wallet

While popular crypto exchange Crypto.com has an Earn feature which offers staking rewards, we’ve chosen to instead feature its self-custody DeFi wallet instead as the centralized exchange product isn’t available in the US.

The DeFi wallet gives a wide range of available tokens to stake including popular stablecoins DAI, USDC, and USDT. There are also staking options available on the Cronos ecosystem.

One feature that is slightly cumbersome is the requirement to top up your wallet via a Crypto.com account or by transferring assets from another wallet.

Self-Custody: Yes

US Availability: Yes

Global Availability: Yes

Available Assets: Stablecoins and many others

Devices: Mobile (iOS & Android)

Coinbase

Coinbase is the most popular crypto exchange in the US and for good reason – their easy to use interface is often the gateway for many users entering crypto for the first time. The Coinbase app offers limited staking options on crypto assets but does support popular stablecoins like DAI and USDC in certain jurisdictions. While Coinbase is a centralized exchange and therefore there isn’t much visibility on how yields are sourced, the rates seem in line with staking rewards seen on Proof-of-Stake protocols like Algorand and Cardano.

Self-Custody: No

US Availability: Limited

Global Availability: Limited

Available Assets: ALGO, ATOM, XTZ, ADA, USDT, DAI, USDC

Devices: Desktop & Mobile

Conclusion

This article covered the basics of staking and some staking options either through self-custody wallets or traditional crypto exchanges. With any of these options you should do your own research to find the platform that’s best for you. We’d love you to try our DeFi wallet – Minke. It’s available on the iOS App Store now!

Disclaimer: This is not financial advice. All advice in this blog is general in nature and does not take into account your individual situation. You should consult with a professional or do your own research before investing.